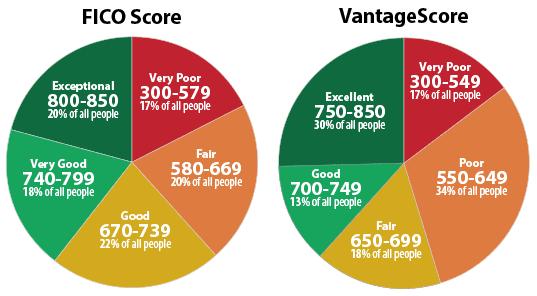

Why is that important? Because if you get your score, you need to know the range you are looking at so you understand where your number fits in. There are many different credit scores available to lenders, and they each develop their own score range. Or both lenders might offer credit to anyone with a score of at least 650, but charge consumers with scores below 700 a higher interest rate! Another might be more selective and only approve those with scores of 750 or higher. One lender that is looking to approve more borrowers might approve applicants with credit scores of 680 or higher. That’s because lenders all have their own definitions of what is a good score. How does my credit compare to others? Find out now for FREE. Within that range, there are different categories, from bad to excellent. Most scores – including the FICO score ( what is a FICO score) and the latest version of the VantageScore – operate within the range of 301 to 850. When it comes to figuring out what makes a good credit score, there are a few different schools of thought.

Learn what is a credit report and the difference between credit score vs credit report.īut trying to pin down a specific number that means your credit score is “good” can be tricky. After all, a credit score is one of the important determining factors when it comes to borrowing money – and getting a low rate when you do. A good credit score is what each of us aspires to.

0 kommentar(er)

0 kommentar(er)